"Operational excellence, sweating new assets, strong business portfolio coupled with technologically intensive portfolio of Novelis, and a focused approach to ensure a robust future" - Mr. Kumar Mangalam Birla, Chairman, Hindalco

16 September, 2015

Share16 September 2015

Addressing shareholders at Hindalco’s 56th Annual General Meeting, Mr. Kumar Mangalam Birla, Chairman, remarked that improved aluminium fundamentals, large scale smelting curtailment by global majors, supported the aluminium price recovery. Consequently the global primary aluminium industry moved back to a deficit position for the first time in seven years.

The average aluminium LME price was around 6 per cent higher than FY14. On the other hand, copper LME price was 8 per cent lower than the previous year, driven by the slowdown in the Chinese demand growth and higher mining output. Aluminium realisations were strong on the back of supportive LME and high regional premium. The average premium at $390 (MJP) was almost 47 per cent higher than FY14. However in the current fiscal, LME has fallen sharply and the premium has nosedived.

While the price of crude witnessed a sharp decline during the year, in India, coal prices increased substantially with rising demand and the shortage of coal. The acuteness of the shortage was accentuated by regulatory developments and infrastructure bottlenecks.

In the context of these developments, Mr. Birla commended Hindalco’s performance. The company attained a consolidated turnover of $17 billion (Rs.1.04 lakh crore) and an PBIDTA of $1.6 billion (Rs.10,049 crore), a growth of 8 per cent and an PBIDTA margin of 9.6 per cent in FY 14-15.

Mr. Birla said, “The business set a new record both in terms of metal volumes and turnover, as our expansion projects stabilised and ramped up. Utkal Alumina refinery has achieved near-full capacity utilisation and is already amongst one of the lower cost alumina refineries globally. Mahan has now ramped up fully. Aditya smelter has ramped up to nearly 55 per cent of its capacity. It will reach full capacity levels this fiscal. On the back of these ambitious, new-age projects, aluminium volumes in India jumped 37 per cent to 0.8 million tonnes and alumina output soared by 40 per cent to 2.3 million tonnes. EBITDA from Aluminium Business in India, including Utkal, rose by 62 per cent in FY15 to Rs.2,345 crore.”

The de-allocation of coal blocks by the Supreme Court last year, was a disruptive change in the business environment for its Aluminium Business. “Our expansion strategy was closely hinged on to the coal blocks allocated by the government. In the changed scenario, Hindalco participated in the fiercely competitive auctions of coal blocks and managed to bag four coal blocks, securitising approximate 25 per cent of its total coal requirement,” remarked Mr. Birla.

Copper Business’s performance has been noteworthy, recording the highest ever volumes of 386,000 tonnes. Its EBITDA of 258 million dollars (Rs.1,601 crore), reflected a growth of 45 per cent over last year. Operational efficiencies, lower cost of production; coupled with the favourable trend in treatment and refining charges, have been their success drivers.

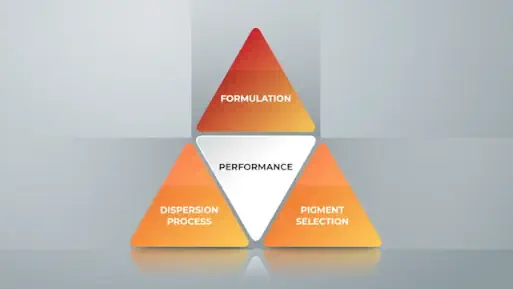

Referring to Novelis, Mr. Birla stated, “Novelis came closer to the fruitioning of its strategic goals of realigning the product portfolio towards premium products, including auto; and increasing the recycled content in its input material. Novelis’ shipments grew in all regions, crossing the 3 million tonne mark. Rolling expansions in Brazil and Korea played a key role. Its adjusted EBITDA increased 2 per cent to 902 million dollars, despite several market headwinds.”

Focusing on Hindalco’s future prospects, Mr. Birla opined, “The commodity markets, and in particular the aluminium industry, are going through a challenging phase at present because of the sharp slide in realisations. This would impact Hindalco’s performance in the near term. Nevertheless, with the addition of world-class assets in the recent years, the company is well poised to ride the structural growth trends such as increasing urbanisation, light-weighting of vehicles and growth in emerging markets.”

Summing up, Mr. Birla said, “FY16 onwards, following the full ramp up of the projects, Hindalco’s financial performance will be significantly impacted as interest and depreciation flow through the P&;L statement. It is in this context that the short term outlook for domestic Aluminium Business would be testing. In the coming years, the focus will continue to be on operational excellence and increasing the productivity of new assets. The company has a strong business portfolio comprising the de-risked Copper Business coupled with the technologically intensive portfolio of Novelis. Along with this, its focused approach, would go a long way in ensuring a robust future.”