“Hindalco poised for greater growth given its robust business portfolio that ensures long-term sustainability Bolsters renewed sense of optimism” - Mr. Kumar Mangalam Birla, Chairman, Hindalco

14 September, 2016

Share14 September 2016

Mumbai

Addressing shareholders at the Hindalco’s 57th Annual General Meeting, Mr. Kumar Mangalam Birla, Chairman, providing an overview commented that “In FY 16, the Aluminium industry witnessed significant challenges as the average realistions crashed. The average aluminium LME was 16 per cent lower than the previous year while the premium was down by 68 per cent as compared to that of FY 15. Regardless the aluminium demand continued to remain strong. The cost deflation, especially energy costs coupled with depreciation of several local currencies vis-à-vis USD, resulted in a sharp decline in the aluminium cost curve. This exerted a lot of pressure on the LME prices. Currently, though the prices appear to have bottomed out. In the Indian context, the demand scenario has been encouraging. The expected economic turnaround and improving industrial activity bode well for Hindalco. The decline in coal prices in India was a major relief. Depreciation of the Indian Rupee also helped Hindalco to an extent. However, the overcapacity in China and the consequent flooding of aluminium in the Indian market severely upset the balance, as imports surged in FY 16.”

Moving on to Copper, Mr. Birla remarked that – “2015 was a challenging year. Refined copper consumption growth declined sharply from 5.5 per cent in 2013 and 4.6 per cent in 2014 to 1.6 per cent in 2015. The global refined copper consumption in CY 2015 was around 22 million tonnes. This fall in the consumption growth trajectory was primarily on account of the slower growth in Chinese demand and de-growth in Japanese consumption. Copper demand is facing challenging times as China is moving away from an investment led economy to a consumer driven economy. The lower demand coupled with the ample availability of concentrate manifested in healthy TC/RC. By- product prices, especially sulphuric acid and fertilisers, were also supportive as the local demand was good.”

In Mr. Birla’s view, the expected domestic revival in demand especially from the power and housing sector, portend well for Hindalco. Given the improvement in Indian GDP, co-product prices are expected to be encouraging. This should bolster the copper business. With the increasing thrust on the agriculture sector, the demand for DAP and sulphuric acid should rise too.

Against this challenging backd;rop, Mr. Birla said that Hindalco delivered an exceptional operational performance. The aluminium business posted its highest ever production, crossing the one million ton mark for the first time. The Company’s three Greenfield projects – Utkal, Mahan and Aditya Aluminium, have now ramped up to their full capacity.

Remarked Mr. Birla, “Hindalco has invested substantially in world-class upstream and downstream facilities. We are fully attuned to the Prime Minister’s Make in India initiative. Towards this, we shall continue to bring world class manufacturing practices in future as well, to make India even more of a global manufacturing hub”.

The operating efficiencies are getting better and better, following the ramp up of these two world-class aluminium smelters (Mahan and Aditya Aluminium) and the Utkal alumina refinery. Cost efficiencies of the Company are at an all-time high. Value added products continue to remain a focus area.

The copper business, a strategic component of Hindalco’s portfolio, continued to deliver robust operational and financial performance, supporting the Indian business.

The Company registered a consolidated turnover of US $15 billion and a PBIDTA of US $1.5 billion.

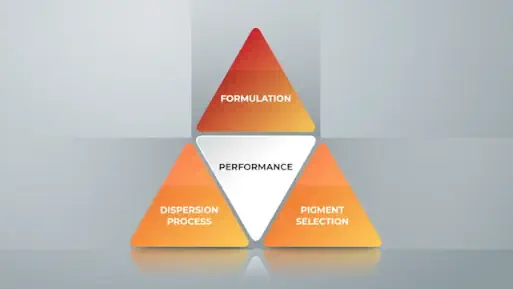

Furthermore, dwelling on Novelis, its wholly owned subsidiary, Mr. Birla commented – “Novelis faced significant head winds as it continued to ramp up production from the newly commissioned facilities. A sharp decline in regional premium (which unlike the LME cannot be hedged) resulted in a Metal Price Lag, which adversely affected its financial performance throughout the year. Operationally, however, Novelis clocked a strong performance. This was primarily achieved on the back of a sharp focus on the product portfolio, which resulted in a higher realisation. Novelis indeed has progressed remarkably well on its strategic path, and auto investments made by it have already begun showing the desired results.”

On the outlook, Mr. Birla’s view was that “notwithstanding the strong operational performance, the short term outlook is challenging given the structural oversupply and depressed pricing scenario. The sharp increase in imports will continue to impact sales. On the positive side, demand in India is expected to be strong, as we see an improved outlook on industrial and infrastructure growth. The government’s thrust on the power sector works well for the aluminium and copper industry. We are also sharpening our thrust on downstream value added products in India, as these yield better realisation.”

Additionally, Mr. Birla opined that “Aluminium usage in automobiles is rising and is expected to increase substantially. All the five new auto lines of Novelis have been commissioned. The production of automobile sheets is expected to grow substantially in the coming years. We have recently completed an ambitious investment program, both in India and abroad. It has not only increased our capacity but has also improved our competitiveness in terms of cost, product mix and quality.”

Moving forward he emphasized that the Company’s thrust will be on operational excellence and increasing the productivity of new assets, cash conservation and de-leveraging. Hindalco has already secured around 25 per cent of its coal requirement in the recently concluded coal linkage auctions. This, along with the existing linkage for Renusagar power plant and captive coal mines, will provide adequate coal security and good visibility to power cost for aluminium production. Mr. Birla characterized this is as a significant development, considering the Company’s cost competitive alumina value chain, including Utkal Alumina, which should help bolster Hindalco’s cost competitiveness.

Mr. Birla reinforced the fact that “Hindalco has a very strong business portfolio. It comprises of the de-risked convertor businesses namely copper smelting and Novelis, along with the cost competitive aluminium upstream operations. Both of these will enable ensure long-term sustainability of the Company. I look forward to the future with a renewed sense of optimism.”