Birla India GenNext Fund collects over Rs. 500 crore during new fund offer

29 July, 2005

Share29 July 2005

Birla India GenNext Fund, a new innovative fund targeting growth of capital by investing in equities of companies that are expected to benefit from the consumption habits of the young generation in India, has collected over Rs 500 crore. The new fund offer closed on 13 July 2005.

Mr S V Prasad, CEO, Birla Mutual Fund, said, "The overwhelming response received from over 55,000 investors reaffirms their faith in the disciplined investment approach which schemes of Birla Mutual Fund follow." He added, "Inspite of the Sensex being at an all time high, the investors have chosen this investment option due to its focused and innovative theme of targeting the consumption habits of the Indian youth."

Besides having the maximum entry load of 2.25 per cent, the scheme also had an exit load of 1per cent (for investors exiting before six months) to encourage only long-term investors. Moreover, as an investor-friendly measure, the AMC decided to absorb the initial issue expenses, over and above the entry load, within the overall recurring expenses rather than passing these expenses to the investors as is usually the current practice. This move of the AMC has ensured that all investors are treated fairly and equitably and that the investors do not bear the burden of issue expenses.

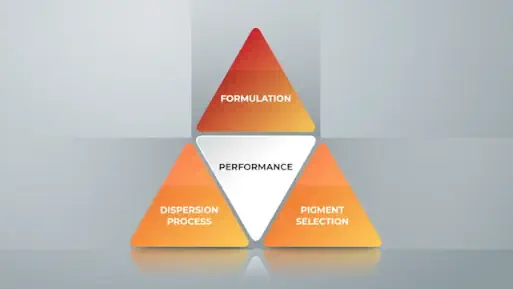

Birla India GenNext Fund is an open-ended diversified equity fund, which would focus its investments in companies that are directly catering to consumers. The consumption boom in the country is expected to gather pace as a large proportion of our population moves into the working age bracket in the next few years. The investments in the scheme would be spread across a universe of industries such as automobiles, travel and tourism, healthcare, banking, utilities, retailing, housing, consumer durables etc. The products/services of the target companies would typically have a distinct brand identity. Focus would be on companies that are cash generating, have a predictable growth in earnings and are quick to adapt themselves to the ever-changing needs of customers.

Birla Sun Life Asset Management Company Ltd (BSLAMC) the investment managers for Birla Mutual Fund, is a joint venture between the Aditya Birla Group and Sun Life Financials Inc. of Canada. With total assets under management of over Rs. 11,000 crore (including domestic assets, offshore assets), BSLAMC has consistently endeavored to provide investors with superior risk adjusted returns in a family of funds, which include diversified and focused equity schemes, balanced and monthly income funds, and a wide range of investment schemes designed to cater to every need of the investor.