Aditya Birla Fashion buys India rights to Forever 21

06 July, 2016 | Financial express

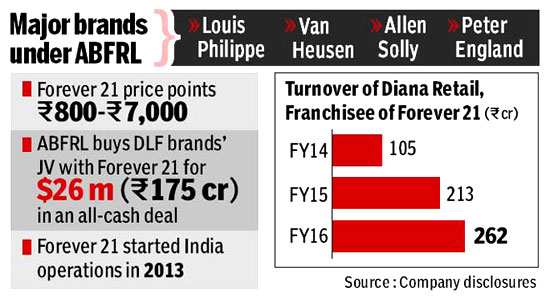

SharePays $26 million to acquire exclusive offline and online rights

In a $26 million dollar transaction, Aditya Birla Fashion and Retail (ABFRL) has become the joint venture partner of US fast fashion major, Forever 21, replacing DLF Brands. A statement released on Wednesday said that the company was acquiring Forever 21’s exclusive offline and online rights in the country, including its existing store network.

Disclosures by ABFRL revealed Diana Retail, the current franchisee of Forever 21 reported revenues of Rs 262 crore in FY16, having more than doubled the turnover in two years.

Sources said the apparel company, which currently has 12 stores across Mumbai, Delhi and Bengaluru, had been dissatisfied with the pace of growth and consequently opted to team up with ABFRL.

The company had originally planned for 50 stores in five years; in addition to Chandigarh, where it has a presence, the US firm is planning stores in other Tier II cities such as Coimbatore and Surat, sources said. Arvind Singhal, managing director at consultancy firmTechnopak believes it’s a good fit. “ABFRL is one of the largest apparel players in the country and apparel is a core category for the company, which was not the case with DLF Brands. For a brand that is focused on teen fashion at moderate prices (Rs 800 -Rs 7,000) and an aggressive expansion agenda, ABFRL is a more strategic fit,” Singhal observed.

At least three mall developers FE reached out to said Forever 21, one of the first international brands that set up shop in the country is also one of the best performing. Mukesh Kumar, senior vice president of Infiniti Mall said that the brand has maintained its run rate or average trading density despite competition from newer entrants like Zara, H&;M and Gap. “Fast fashion as a category is growing at a healthy pace, maybe between 15 per cent and 20 per cent and within that, Forever 21 is definitely among the top three or four brands,” Kumar added.

Infiniti Mall houses Forever 21’s first store in India. Sources from mall development companies said in some locations, Forever 21 clocks in higher trading density than industry major, Zara.

Sector specialists pointed out that although the exact contours of the deal have not been revealed, it would be safe to assume that in keeping with its DNA, ABFRL has signed a long term partnership with the US fashion brand, probably spanning more than a decade. Unlike DLF Brands, ABFRL has manufacturing units that could become sourcing hubs for Forever 21.

While the US firm also has its own e-commerce platform, it currently sells its clothes and accessories through the fashion portal Myntra.

How exactly the online channel will work now remains unclear but as industry watchers point out, the brand’s online sales account for a minuscule 4 per cent of its total sales.

Initially, the JV—between Forever 21 and DLF brands—was pitch perfect; Forever 21 was to occupy space at a competitive rent in DLF’s own malls. But over a period of time, it turned out that DLF’s malls were not always the most lucrative shopping destinations.

That meant Forever 21 needed to have a different expansion plan, given that competing brands like H&;M and Gap are aggressively multiplying store presence.

This is the third major brand that DLF Brands has let go. Others include Mango and Sephora. At the moment Mothercare, Sunglass Hut and Claires are the prominent international brands that DLF still has under its umbrella. DLF Brands did not participate in the story so its game plan remains unclear.